Important disclaimer and disclosure: this is a personal opinion. I am not a financial advisor or analyst and I may be wrong in both the data and my interpretation or opinion. Do your own due diligence. None of this is investment advice of any kind. I currently own shares of Thryv Holdings, Inc.. I may sell, hold, or buy more shares without notice.

Name: Thryv Holdings, Inc.

Ticker: THRY

Stock price on November 21, 2024: $14.46

Table of contents

Introduction

Investment Thesis at a Glance

The SaaS Business

The Legacy Business: traditional marketing services

Evolution of the SaaS-Legacy Mix

The Management Team and the KEAP Acquisition

Competitors and Comparison to Peers

Risks

Conclusion

Introduction

Thryv is a U.S. company offering two very different types of services: traditional marketing services, primarily YellowPages in paper and online, and Software-as-a-Service (SaaS) solutions for Small-and-Medium-Businesses (SMBs), which currently consist in a CRM platform, online marketing tools and programs, and a hub for communications.

First of all, let me explain briefly the path to this strange business mix.

The company's origins can be traced back to a corporate turbulent period. In 2017, Dex Media acquired YP Holdings, both Yellow Pages providers which were struggling to adapt to the digital age. Dex Media itself had recently emerged from bankruptcy and was heavily indebted. Its former lenders, primarily Mudrick Capital, had took ownership of the company. In autumn 2020 the company, now renamed Thryv Holdings, re-listed on the Nasdaq, burdened by significant debt and restrictive covenants. Mudrick Capital remained a major shareholder, and for that reason Thryv was considered a "controlled company". This complex financial situation shaped the company's strategic direction and operational constraints.

As you can see, the company’s origins were a bit complicated, to say the least. And as you’ve surely guessed, the Yellow Pages business is not exactly buoyant, neither was it during the merger nor at the time of the 2020 new listing.

However, interesting developments were taking place within the company. In 2015, Dex Media launched a new SaaS solution for SMBs, called precisely Thryv, primarily focused on modernizing operations for small and medium businesses in the United States. From the outset, management aimed to leverage the limited cash flow available and existing customer relationships from the legacy Yellow Pages business to acquire potential customers for the new SaaS offering. Since then, growing the SaaS business has been the company's top priority, leading to a name change in 2019 to reflect this new focus —Thryv Holdings, Inc.

Around the time of the relisting, THryv had 318,000 marketing services customers and 44,000 SaaS customers. Both numbers had been declining in previous years, for reasons we'll explore later.

Thryv's strategy, under Joe Walsh's leadership, has been clear from the beginning: "hunt" customers —as he usually says —from the declining legacy business and transition them to the SaaS business. While the pace and intensity of this strategy have fluctuated, its core objective has remained consistent, as we'll see later. For example, in the 2017 press release about the merger with YP Holdings, we could see a clear expression of purpose in this respect: "Both of our companies [Dex and YP Holding] have a long history of helping local independent business owners. Now, (...) we will enable these entrepreneurs, the backbone of the U.S. economy, to compete and win against big-box national chains and on-demand service providers. We will arm them with the same business automation software that big enterprises use." And they think they have a huge market to do it: a Total Addressable Market (TAM) of about 4 million potential customers in the US, and 8 million worldwide.

Investment Thesis at a Glance

Thryv is transitioning to a SaaS business and is currently trading at a very attractive valuation, near 1x revenue, while competitors trade at significantly higher multiples. As we'll see, the company is also cheap on an EBITDA basis. Thryv is growing rapidly, has a long growth runway, and is profitable. This profitability is increasing due to operational leverage. Financially, the company is successfully deleveraging, though this remains a key risk to monitor, given its significant debt burden.

Now let's delve deeper into these factors and explore other important considerations.

The SaaS Business

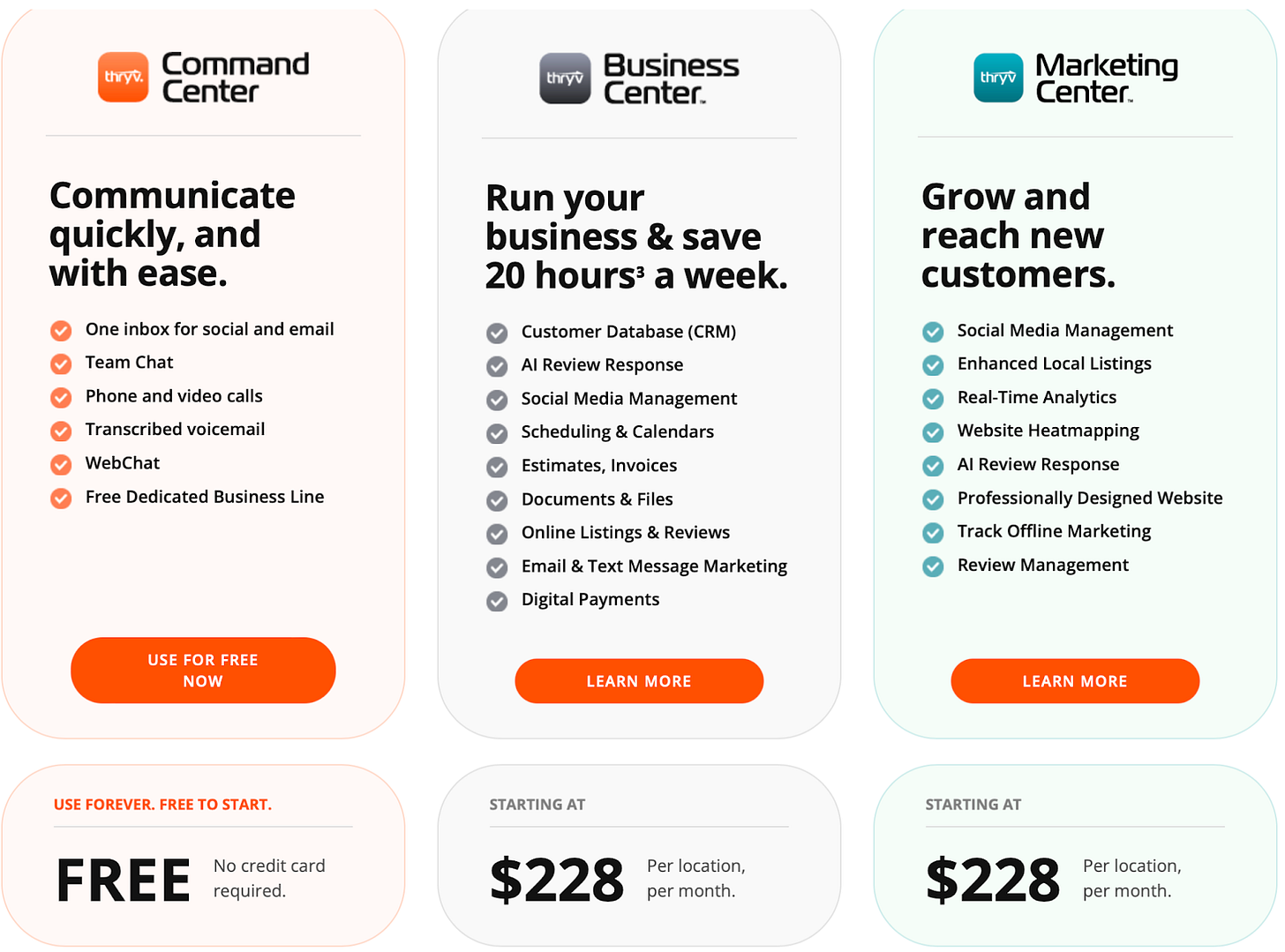

Thryv provides a software solution designed to empower small and medium-sized businesses to manage their operations more effectively. The platform offers a range of tools that have expanded over the years. Currently, Thryv offers three main "centers" or types of solutions:

Business Center: A CRM solution to manage customer relationships.

Marketing Center: Provides marketing services to attract customers, generate leads, and implement marketing campaigns.

Command Center: A hub for communications between SMBs and their clients.

This slide from Thryv homepage provides a more detailed overview of each center and their entry pricing.

Thryv's initial focus was on the Business Center. However, listening to the last earnings calls, you can see that the Marketing Center is receiving the most attention right now. The CEO views the Marketing Center as a more natural transition from the legacy Yellow Pages business, as both focus on expanding a company's reach and attracting customers. In contrast, the Business Center may require a more significant shift in behavior for traditional Yellow Pages customers, many of whom are small and not very tech-savvy. The Command Center, a freemium communication hub, in addition to its contribution to revenues from paid versions, is seen by management as a way to build a new “zoo” or customer base. By attracting users with a free tier, the goal is to build relationships and eventually upsell or cross-sell other centers. This strategy aligns with the company's need to offset declining Yellow Pages subscribers. Management has stated that they plan to release new solutions or centers in the future.

Thryv targets small and medium-sized businesses that are too small for enterprise solutions like Salesforce or even Hubspot, which already targets smaller clients than Salesforce, but are looking to modernize their operations. However, the company has shifted its focus to still small but slightly larger, more stable businesses. This strategic decision was made to improve customer retention and average revenue per user (ARPU). In the annual report of 2020, we could see SaaS subscribers -the driver of Thryv’s growth -going down every year, and a note explaining it: “The decrease in SaaS each period was the result of an intentional strategic move by us to target higher spend, higher retention clients in lieu of lower-spend, higher churn clients. As part of this strategy, we discontinued sale of lower priced tiers of our Thryv platform, which led to higher monthly ARPU for the year ended December, 2020. In making this strategic shift, our SaaS client count has decreased while SaaS ARPU has increased, and we expect this trend to continue into fiscal year 2021”. Given that revenues started again to grow strongly, it seems the strategic movement made sense.

CEO Joe Walsh often emphasizes the resilience of Thryv's customer base, highlighting that they are established businesses with a long history, often in “boring” sectors not very exposed to technological disruption. The top 10 verticals served by Thryv include:

Many times, these people have had a long-standing relationship with Thryv as Yellow Pages customers, fostering mutual trust. This "zoo" of people, as Joe Walsh calls it, significantly reduces the Cost of Customer Acquisition (CAC) and helps control SG&A expenses, according to management. CAC is a critical Key Performance Indicator (KPI) in the SaaS industry and a significant factor in its success or failure. And there are reasons to believe them —Thryv is growing at a 25% annual rate and is already profitable, with increasing profitability due to operational leverage. The SaaS business is currently generating around 11-12% EBITDA and is expected to improve further next year. While older presentations mentioned a 20%+ EBITDA margin goal, and this last goal is not in the most recent presentations anymore (which suggests to me that this objective could be delayed), I believe it's still achievable with increased scale and a moderation in SG&A growth. It's worth noting that the growth isn't isolated to Thryv. Many competitors are also experiencing significant revenue growth. The CEO believes that the current decade will be the "SMB decade," with small and medium businesses following the lead of larger companies in adopting optimization and CRM tools.

Ok, now we have a general overview of the SaaS business. What about going to some numbers? Let’s have a glance at the recent financial performance.

As of September 30, 2024, Thryv had 96,000 customers, trailing twelve-month revenue of $316,185,000, and a TTM adjusted EBITDA of $30,417,000, translating to a 9.62% EBITDA margin. However, a deeper dive into the numbers is necessary to understand the underlying trends. While I won't provide an exhaustive analysis, here are some key points to consider:

EBITDA: EBITDA was negative in Q1 2022 and barely broke even for the rest of the year. It started to gain traction in 2023 due to higher revenues and operating leverage. So, in my opinion, you should not take this ebitda margin as the stable one, given what part of a business life cycle Thryv is now in. While a 20% margin might be achievable in the long term, a more conservative estimate of 15% seems reasonable.

It's important to note that some accounting issues unrelated to the core business have temporarily depressed EBITDA, mainly certain expenses associated with the legacy marketing services business that have been allocated to the SaaS EBITDA due to accounting reasons, management says. These factors are not indicative of underlying SaaS business performance and should normalize over time.

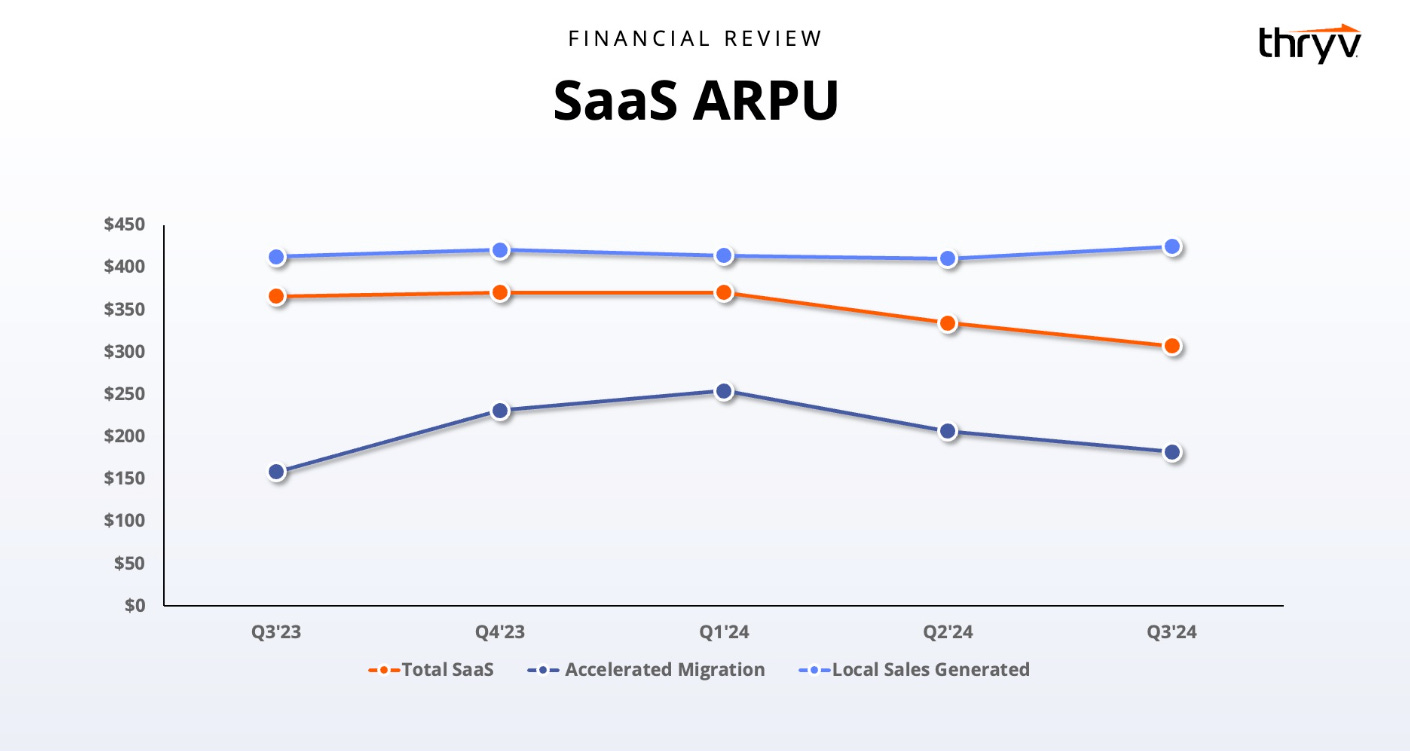

Average Revenue per User (ARPU), is a critical metric to monitor. In recent quarters, ARPU has declined from around $350-$380 to approximately $300. It would be a clear red flag in any subscription based company, but we have to find the rationale for the movement. This decline is a result of Thryv's aggressive strategy to transition legacy customers to the SaaS platform, which involves offering lower introductory prices and freemium tiers. While this strategy is necessary to accelerate growth, it puts pressure on ARPU. Management believes that ARPU will recover in the future as the company transitions to a higher-value customer base.

Customer Growth: Thryv has experienced significant customer growth, with a 45% year-over-year increase in subscribers to 96,000 in Q3 2024. Sequential growth has also been strong, with 21% QoQ growth in Q2 and 13% QoQ growth in Q3. This rapid growth is driven by the aggressive customer acquisition strategy, including lower-priced offerings and freemium tiers. While this strategy may temporarily impact ARPU, it's essential for driving long-term growth.

To provide some more clarity, Thryv has started to separate the ARPU of new, lower-priced customers from the ARPU of more established customers. This will help investors better understand the impact of the acquisition strategy on the overall business:

Despite the doubts that the under-pressure ARPU can generate, you can see more directly how other metrics are improving. Net Dollar Retention has reached for the first time the objective of 100% (a bit more, actually), from the low 90% in the last quarters. Adjusted Gross Margin has gone from a 66.6% to a 72.2% YoY. And the users that are subscribed for more than one center (increasing revenue per user) has gone from 5% to 12.3% year over year. And by the way, management has proven capable of delivering on their promises. As we discussed earlier, they implemented a strategy of sacrificing short-term subscriber growth to improve ARPU. This approach led to a temporary decline in subscribers, but it has ultimately resulted in a stronger growth, higher ARPU and better retention rates. Given these facts, I believe Joe Walsh and his team deserve some credit.

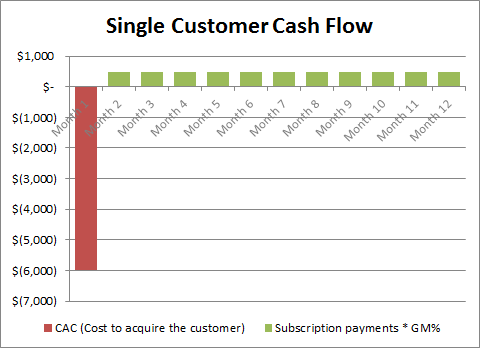

Acquiring customers can be challenging for SaaS companies, typically involving a significant upfront expense that's treated as an operating cost, not a capitalized asset. As a relevant example, consider this graph from FromEntrepreneurs.com, a website I highly recommend for anyone interested in SaaS economics and this industry in general.

That example implies a CAC of $6,000 and monthly payments of $500.

So, it's reasonable to assume that if you can afford it because you are profitable, you can invest by reducing initial revenues rather than spending more. If we believe management's claims—and the early profitability of the business, sustained profitability despite high growth, and the advantages of having available the marketing services “zoo” seem to support this believe—Thryv's CAC is relatively low, allowing it to absorb the pain on the revenue side. Again, I'm not saying this strategy is guaranteed to be successful, but it seems logical, albeit aggressive.

Considering all these factors, I believe the company could reach 150,000 clients in the next twelve months, including the 17,000 from the KEAP acquisition. Assuming a more normalized ARPU of $350 per month (still conservative, if we trust management) this could lead to potential revenue of 150,000 clients X $350 x 12 months = $630 million. As of November 21th, after the recent dilution to finance the KEAP acquisition -we will talk about this-, the company has a market cap of about $600 million, approximately. A 1x revenue multiple for a business growing at over 20% per year and improving economics seems quite inexpensive. And if we apply a 15% EBITDA margin, we have about $90+ million, which gives us a 6 or 7 times EBITDA, a really attractive price for a business of these characteristics.

The Legacy Business: traditional marketing services

Thryv's transformation echoes the classic tale of the Ugly Duckling. The traditional, outdated legacy business transforming into a vibrant, modern SaaS company that the market loves (and yes, the SaaS is the swan, in case you don’t get it…).

The traditional marketing services, mainly Yellow Pages in paper and online, were the core business of both Dex and YP Holdings before their merger. Thryv inherited a massive customer base of hundreds of thousands of legacy clients. While this iceberg is shrinking rapidly -about a negative 20% or even 30% every year-, with only 251,000 clients remaining in Q3 2024, it still represents a significant revenue stream. This declining business has been crucial for generating cash flow, paying down debt, and funding the early stages of the SaaS business.

The marketing services business is divided into two segments: traditional print Yellow Pages and online directories. It's clear that they cannot compete with Google, Facebook, or Instagram in the advertising space. The company has recognized this and is not trying to prolong its life. Instead, it has focused on extracting cash flow to pay down debt and fuel the SaaS business. Given its declining nature, there's no need to delve too deeply into the details of the marketing services business. The key point is that it's a shrinking business, and management has announced recently their plans to wind it down by 2028. However, it still generates millions of dollars in revenue and can contribute to acquiring new SaaS customers.

It's important to note that the marketing services business can be noisy from an accounting perspective. Revenue recognition and printing cycles can introduce fluctuations in revenue and EBITDA, making the business appear more volatile than it actually is. To get a clearer picture, investors should focus on billings and cash flow. However, these fluctuations can obscure the underlying growth of the SaaS business and potentially deter investors who rely on aggregated data. This can create a buying opportunity for those who understand the underlying dynamics. As the legacy business continues to decline and the SaaS business grows, the consolidated financial picture will become increasingly dominated by the latter. This will ultimately resolve the noise and volatility associated with the legacy business.

Evolution of the SaaS-Legacy Mix

As previously discussed, Thryv's strategy consists of leveraging the legacy business to fuel the SaaS growth continues. However, the pace of this transition has accelerated significantly in recent quarters. While this shift towards a more SaaS-focused business is generally positive, it's important to remember that the legacy business has been a critical source of cash flow for debt reduction. An overly aggressive cannibalization of the legacy business could deprive the company of this vital cash flow.

The key question is whether the accelerated growth in SaaS subscribers will compensate for the decline in the legacy business. While subscriber growth has been impressive, the downward pressure on ARPU has tempered revenue growth. For example, while subscriber growth was 45% year-over-year, revenue growth was only 29%. This disparity highlights the impact of the aggressive pricing strategy to attract new SaaS customers.

The challenge for Thryv will be to retain these new customers once introductory offers and low-price tiers are phased out. There's a risk that customers who initially signed up for low-priced plans may not be willing to pay higher prices in the future. Will clients be successfully convinced once they have to pay more?

While Thryv's management team has demonstrated a strong ability to execute, this aggressive strategy requires careful monitoring. A well-executed transition could lead to significant long-term growth, but missteps could severely impact the company's financial performance.

The Management Team and the KEAP Acquisition

I'll discuss the management team and the recent acquisition together, and I’ll do it for a reason.

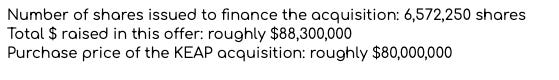

First, let's talk about the acquisition. In late October, Thryv announced the acquisition of KEAP, a software company that operates a SaaS e-mail marketing and sales platform for small businesses, including products to manage customers, customer relationship management, marketing and e-commerce. This acquisition aligns well with Thryv's strategy and offers clear synergies. However, the market reacted negatively to the financing method.

I believe Thryv is undervalued, a sentiment shared by the CEO. The company had even initiated a share repurchase plan. Surprisingly, they chose to finance the acquisition by issuing new shares at a significant discount to the market price—around $14 per share. Previous stock price was about $18, and management had expressed that for them the stock price was very cheap. So, understandably, this move disappointed the market, and the stock price has declined further to the $13 range.

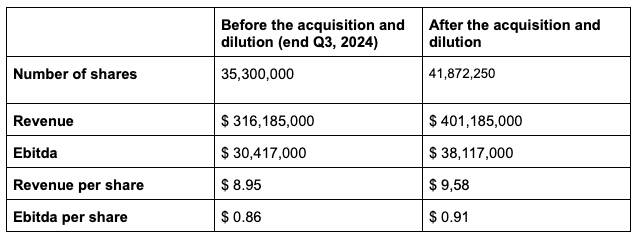

One might question the rationale behind issuing shares at such a low price –What the heck were they doing? Of course, it is a movement that should be questioned. I was hoping for questions about this in the Q&A, but there weren't any, I believe. However, and although I can only speculate, I think they saw an opportunity to acquire KEAP at a very attractive valuation, roughly 1x sales. By issuing shares at a discount, they effectively increased the overall value of the combined company on a per-share basis. While I'm not a fan of dilution at such low prices, I understand the strategic rationale. It's important to note that this is just my interpretation, and I may be incorrect. Here my numbers:

And there is more. According to a leaked internal email posted on X, KEAP might not have received their desired valuation, and the deal was primarily structured to pay down debt. If the company was in a precarious financial position, this might have been a sudden opportunity they couldn't pass up, despite the dilutive share issuance. Raising additional debt would have been risky, considering debt is already a significant concern for the company. Adding another $80 or 90 million of debt would have further increased risk too much and led to a higher cost of capital for the equity part.

Other reasons are the synergies. I know, this is the kind of buzzword every manager talks about in M&A. But given KEAP complementary services to offer and some business in Europe, there might be potential for significant growth and cross-selling opportunities. Additionally, Thryv's management has estimated potential cost savings of around $10 million once the integration is complete.

So, yes, the dilution is not good at this price, but you can’t say it’s a bad move too quickly, and there are reasons to guess that it can be of significant value for the future of the company.

Let me somehow connect these points to my comments about the management team, specifically Joe Walsh, the CEO. Walsh joined Dex Media in 2014, so he’s been a decade in the company and has experienced the process of the bankruptcy. In my view, he is a seasoned manager, and he is up to now succeeding in the not-easy task of transforming Thryv from a debt-laden, declining business into a growing SaaS company. In addition, he has a significant stake in the company, which is reassuring given the company's reliance on execution. This alignment of interests is a key factor in my trust in his leadership.

Importantly, the management team has consistently delivered on the important task of debt reduction. They have significantly reduced it, refinanced at lower rates, and consistently decreased interest payments. While debt remains a concern, their commitment to reducing it is evident.

The management team has also been transparent about temporary issues, such as declines in marketing services revenue or SaaS EBITDA when due to accounting factors, coming back later to more normalized levels. Given this track record, I have confidence in their assertion that the current decline in ARPU is temporary and part of a strategic initiative. This is however a really critical point to follow closely.

Now, while my overall opinion of management is positive, there are some things I don't like very much.

First of all, although this one is just for my personal taste, I do have some reservations about Walsh's communication style, because -and repeat, this is very personal –I find it a bit of a sales-pitchy way of talking and in the calls the challenges of the company may appear understated.

Another concern is the lack of transparency regarding certain aspects of the business. For example, the company has reduced the level of detail provided about its international operations, particularly in Australia and New Zealand. While this may be due to various reasons, it raises questions about the performance of these segments. As a shareholder, I would prefer more granular information to assess the overall health of the business, and my confidence is undermined if I can no longer see data that I could before, and that I consider important.

Similarly, I would like to see more detailed information about the performance of different segments within the SaaS business, between the KPIs within the different centers. Understanding the growth and profitability of each segment can provide valuable insights into the company's future prospects.

Ok, some last words about management and coming back to KEAP acquisition. While the dilutive share issuance was disappointing, it's important to consider the broader context. Joe Walsh and his team have a strong track record of executing on their strategy, even in challenging circumstances. They have successfully navigated a complex financial situation, transformed a declining business, and demonstrated their ability to execute acquisitions and integrations. While past performance is not a guarantee of future results, it does provide confidence in the management team's ability to navigate future challenges and capitalize on opportunities.

Competitors and Comparison to Peers

While a deep dive is beyond the scope of this analysis, let's take a quick look at some of Thryv's key competitors to gain a broader perspective. It's important to note that the data used here comes from TIKR –a data aggregator –in some cases, so there might be some inaccuracies or missing details. For a more comprehensive picture, I recommend consulting the companies' SEC filings directly.

As Thryv expands its product portfolio, its competitive landscape is evolving. Some of the major players to consider, and maybe the most direct competitors, are:

Salesforce: The 800 pound gorilla and the undisputed leader in the CRM space with over $35 billion in annual revenue. It boasts impressive historical growth rates, although they have slowed down recently (18% in 2023 and 11% in 2024). With strong gross margins (around 75%) and accelerating EBITDA (25-30%), Salesforce sits on a healthy balance sheet with no net debt. While some dilution has occurred, it hasn't been excessive. It trades at about 8 times revenues and ~28 times EV/EBITDA.

HubSpot: A smaller player compared to Salesforce, HubSpot generates roughly $2.5 billion in LTM revenue and enjoys high gross margins (80-85%). HubSpot boasts a healthy balance sheet with significantly more cash and equivalents than debt. It trades at above 10 times revenues.

You can see other less related competitors, such as Monday.com, which is also trading at much higher multiples than Thryv.

These are just back-of-the-envelope comparisons, but they suggest Thryv could be potentially quite undervalued. Assuming a normal performance, it is trading at a market cap to sales ratio of around 1. This figure uses market cap to sales instead of Enterprise Value/Sales. Why am I doing this? I don’t want to be misleading: the thing is, given that debt is going down quickly and deleveraging is the main financial focus of the company, if you are modeling it for the near term (the company is reducing about $100 million of debt per year, and even if it just pays down the mandatory amount, which is about 60 million, debt is not going to remain in the 300s for long), you should not take at permanent the 300 million debt of now. But even if you add the $300 million debt to the ~$600 million of market cap, it’s still a low multiple of 1.5 or 2 times EV/Sales, significantly under the peers. I am not saying that Thryv has the same level of brand recognition, stability and overall quality as a company like SalesForce, but I think the difference in the valuation is broad enough to discount a large “quality premium” and still have good potential for considerable revalorization of the stock.

Risks

While Thryv might be a potential good investment opportunity, it's important to acknowledge the significant risks involved.

Debt: The company's debt load, currently around $300 million netted, remains a major concern. Although it has been steadily reducing, it still puts a strain on the balance sheet. While the current level of debt is manageable relative to EBITDA, the rapid decline of the marketing services business could impact the company's ability to service its debt. The recent refinancing with less restrictive covenants and lower interest rates is a positive development, but the debt burden remains the risk number one.

Execution Risk: Thryv's success hinges on its ability to execute its strategic plan. The transition from a declining legacy business to a growing SaaS company is a complex undertaking, and there are numerous challenges that could derail the company's progress. These challenges include maintaining a healthy Net Dollar Retention rate, attracting and retaining new SaaS customers, successfully integrating the KEAP acquisition, competing effectively in a competitive market, and upselling existing customers to higher-tier plans.

Customer Base Risk: Thryv's customer base consists of small and medium-sized businesses, which are more vulnerable to economic downturns and other external factors. While the company has a diverse customer base, a significant economic downturn could impact customer retention and revenue growth.

Mixed Reviews: The company's online reviews, particularly on TrustPilot, are frequently negative, which could impact customer acquisition and retention rates.

Competitive landscape: We’ve observed that there are significantly larger peers in the industry. Thryv states that its target of small companies is outside Salesforce’s scope. However, we can see that recently Salesforce is releasing solutions for this niche, more affordable and less complex. Given Salesforce's or even HubSpot’s much higher size and resources, its potential competitive impact cannot be underestimated. In addition, there are numerous small players in the industry that can compete. The good part is that the huge market of small and medium businesses presents ample opportunity for growth for more than just a few companies.

A “regulatory matter”. As a part of the press release where they announced KEAP acquisition, there was also this information, which should be monitored: “On October 17, 2024, the Company received a subpoena from the Division of Enforcement of the SEC requesting documents and information related to the Company’s previously publicly announced strategic conversion of its clients from its digital marketing services solutions platform to its SaaS solutions platform (the “Subpoena”). The Company is cooperating fully. The SEC noted that the investigation is a fact-finding inquiry and does not mean that it has concluded that anyone has violated the law nor that the SEC has a negative opinion of any person, entity or security”.

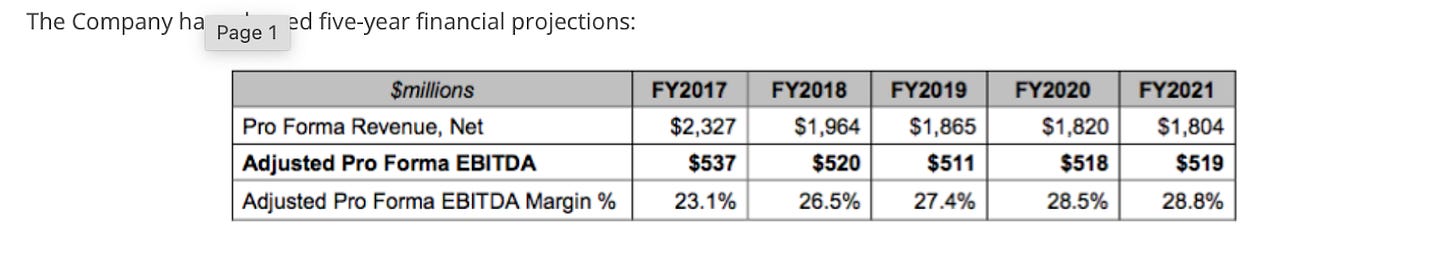

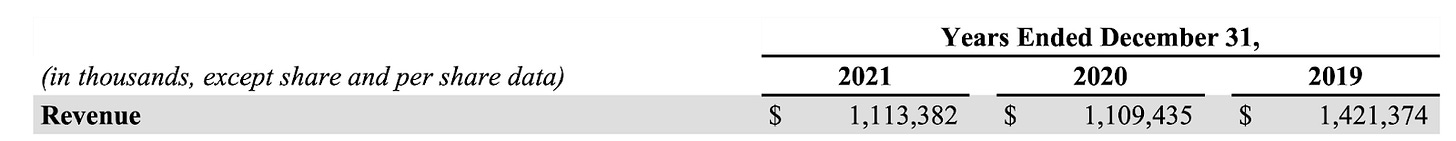

Too much optimism: If you review past Thryv’s communications, you can tell they were far too optimistic about the length of time and the revenues amount they could make up for the legacy part. In the 2017 press release of the merger, they put this table of estimates for the next years:

Compare it with the actual numbers that you can find in the annual report of 2021:

And yes, as we said before, management has stated repeatedly that it is intentional due to the succeed in the adoption of the SaaS solutions and the accelerated cannibalization of the legacy subscribers, and the lower entry pricing of SaaS. But, anyways, this rapid pace of falling in revenues is something not to ignore. The inflection point (the moment when SaaS revenues offset the decline of legacy revenues and the consolidated revenue grows again) is coming soon, for what it seems, but you can’t take this for granted.

Conclusion

Thryv might present an interesting investment opportunity, but it's important to be aware of the risks involved. The company's valuation is low according to my point of view, and the management team has demonstrated a strong ability to execute. However, the debt burden, execution risks, the potential economic headwinds and the competitive landscape are elements to concern. As the company continues to execute its strategy and reduce its debt load, its valuation could appreciate significantly.

All investments carry the risk of loss. And whenever there is a potential risk of bankruptcy, as it is the case here due to the significant debt, one must be even more cautious about how much of their capital to allocate, in case one they decide to invest.

Obviously, It's important to conduct your own due diligence before making any investment decisions.

By the way, if you're a new investor and some concepts or details in the article were unclear, I'm planning to create additional articles titled "Diving Deeper into the Analysis of..." to provide more in-depth explanations about the analysis of the companies I write about. A piece on this one of Thryv is coming soon.

Thank you so much for reading me! It is my first article analyzing a company in Substack. I’m Spanish, so excuse me for the possible language mistakes.

I would really appreciate any feedback, comments or retweets! And of course, is you consider it's worth it, I would greatly appreciate it if you subscribe.