Important disclaimer and disclosure: this is a personal opinion. I am not a financial advisor or analyst and I may be wrong in both the data and my interpretation or opinion. Do your own due diligence. None of this is investment advice of any kind. At the time of this publication, I do not own shares of Tiptree; however, I may purchase them at any time without providing notice.

Along with this article, I’ve also published a brief post on Substack explaining what Excess & Surplus Insurance and Mortgage Origination Business are, for those who may not be familiar with these terms. Those are important concepts for understanding Tiptree, but I’ve kept them in a separate post to avoid overloading this one and to not inconvenience readers who are already familiar with them.

Introduction

Tiptree is a holding company focused on building long-term value by allocating capital to small and middle-market companies across various industries. I believe it is a high-quality company with a management team that has demonstrated good capital allocation skills, making it a potentially good long-term investment to keep on the radar. Additionally, Tiptree presents a likely special situation that could unlock the value of its main business. However, I am not currently an investor, nor am I planning to invest at the moment, for reasons I will explain in the conclusions.

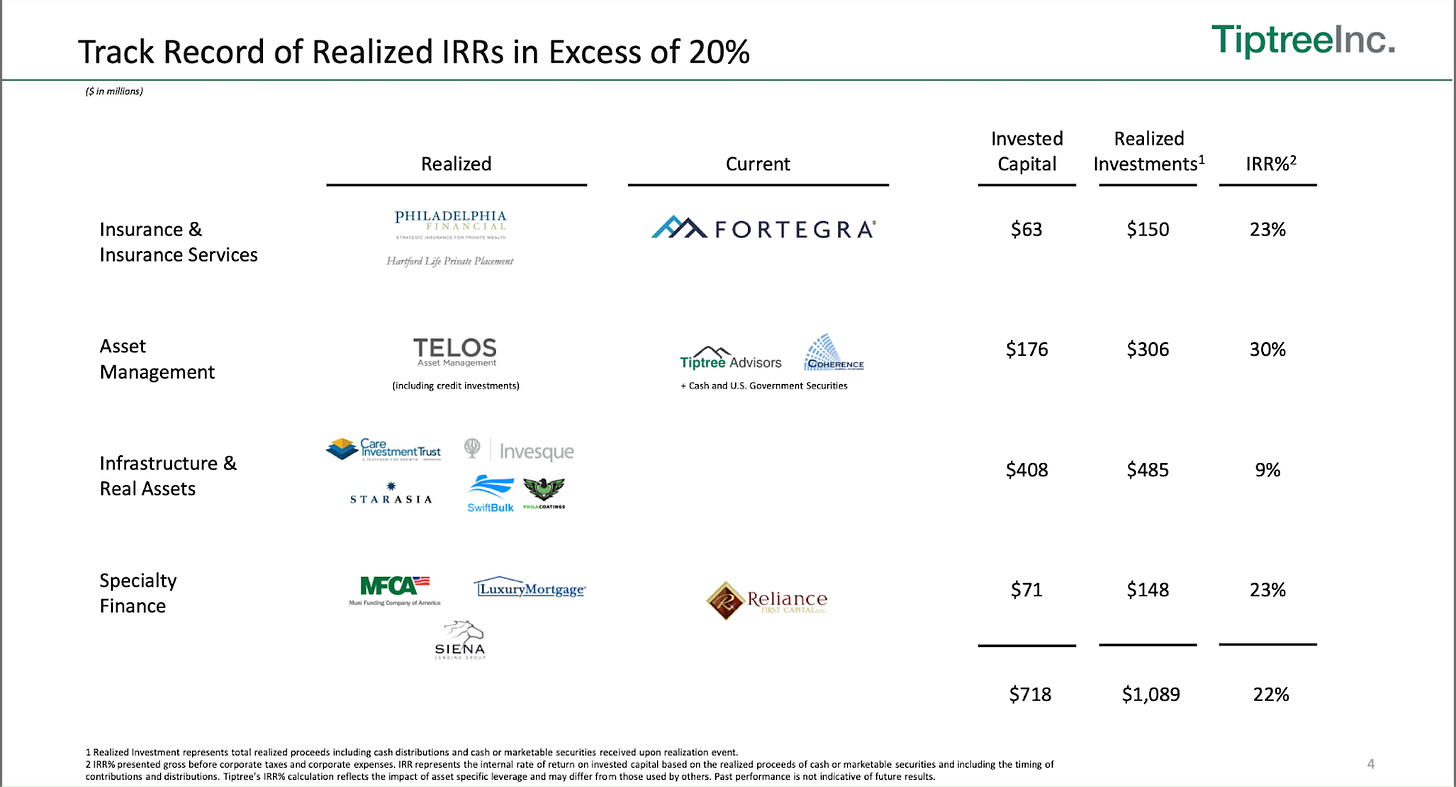

Over the years, Tiptree has held various businesses for defined periods, achieving remarkable returns. The company does not limit itself to specific types of businesses; although they’ve had "a significant track record investing in the insurance and credit-related financial sectors". Below is a summary of the businesses they have been involved with and the realized returns:

Over time, Tiptree has been reducing the number of businesses it is involved in, and it currently focuses on two main ones, along with other smaller and less significant ones.

The insurance and extended warranty business, operated through its subsidiary, Fortegra, is the largest and most impactful part of Tiptree, making it the cornerstone of our investment case. Furthermore, it is currently in a clear special situation.

On the other hand, Tiptree has another business line called Tiptree Capital, which focuses on subsidiaries that allocate the capital not deployed through Fortegra. Within Tiptree Capital, the most significant entity is Reliance First Capital, which specializes in mortgage loan origination.

Since this is a complex company, I'll focus only on these two businesses to keep things simple.

Fortegra (Insurance and Related)

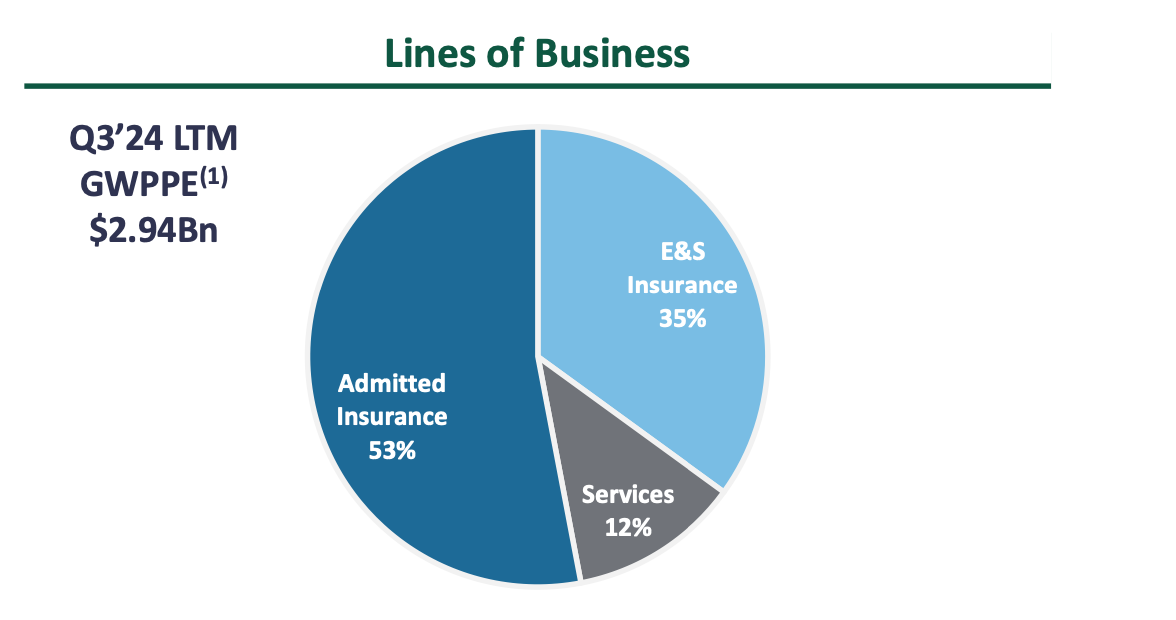

Tiptree's insurance segment is operated through its subsidiary, Fortegra, acquired in 2014. Fortegra specializes in specialty insurance, which focuses on unique or complex risks that are typically not covered under standard insurance policies. A significant portion of this business involves what is commonly referred to as non-admitted risks or the Excess & Surplus (E&S) market.

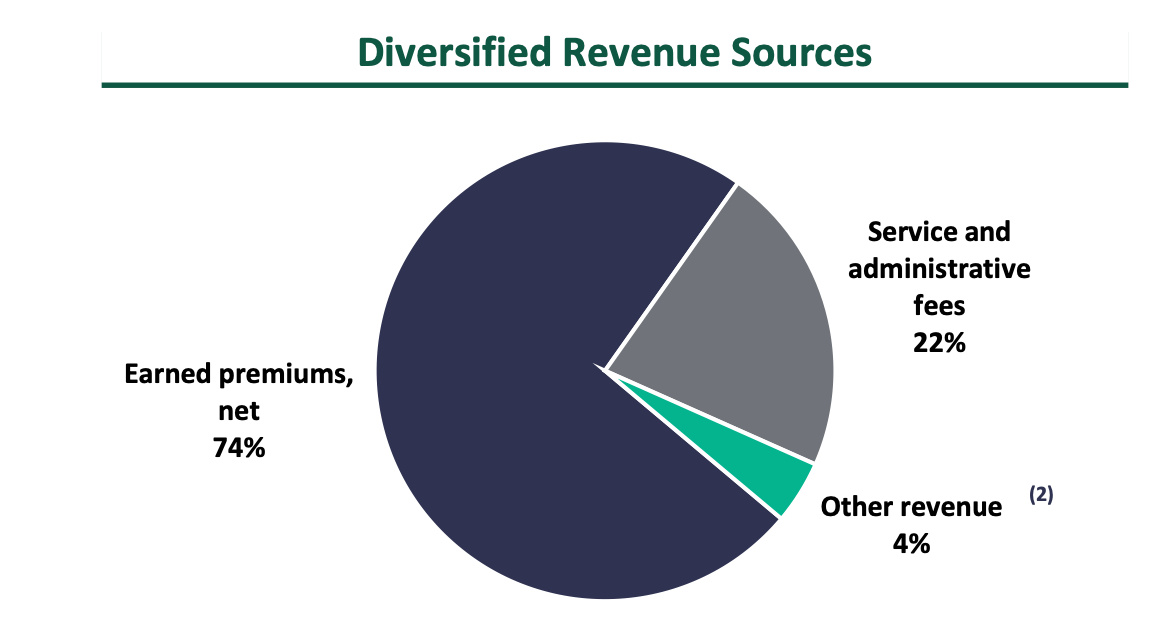

In addition to its insurance operations, Fortegra generates revenue from what it calls “Service and Administrative Fees”. This primarily includes extended warranty services for consumer goods and automobiles. It also has a smaller revenue stream categorized as “Other Revenue.”

Since its acquisition, Fortegra has grown in importance within the company, eventually becoming its most significant part. In 2023, they did $2.748 billion in Gross Written Premiums and Equivalents, $1.32 billion in Net Written Premiums1, and $1.593 billion in revenues. By Q3 2024, LTM Gross Written Premiums and Equivalents were 2.94 billion and LTM Revenues were 1.909 billion.

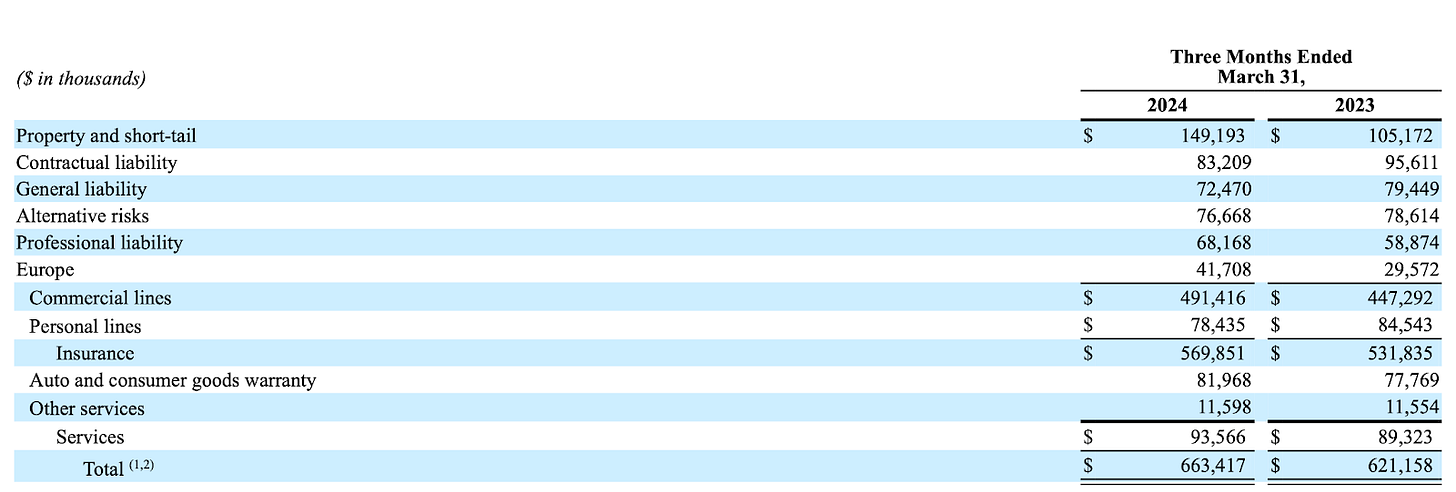

Here is the revenue breakdown of Fortegra from different perspectives.

Let’s explain them briefly:

Insurance:

Commercial: Includes both admitted and non-admitted (E&S) coverages. The company highlights that the E&S insurance part, launched in 2020, has grown to over $820 million in GWPPE (“Gross Written Premiums and Premiums Equivalents”) by December 31, 2023.

General Liability: General and occurrence-based liability, commercial multi-peril liability, etc.

Professional Liability: Professional and claims-made liability, miscellaneous errors & omissions, cyber liability, etc.

Property and Other Short-Tail: Commercial auto physical damage, commercial property, earthquake, homeowners, etc.

Contractual Liability Protection (“CLIP”): Coverage embedded within portions of auto and consumer goods warranty lines.

Alternative Risks: Includes credit insurance products that protect lenders from borrower defaults, and collateral protection products that safeguard commercial entities from losses to collateral securing loans.

Personal: Includes credit protection products related to loan payments, among others.

Services:

Auto & Consumer Warranty: Primarily extended warranties or similar services. Some extended warranty contracts are categorized as insurance, because in Europe "auto and consumer goods warranty products... are regulated insurance products in their locally-issued countries."

Other Services: Derived from various motor club products administered by Fortegra.

As you should already know, insurers make money in two ways: from the profit they earn from the difference between what clients pay for policies and the cost of covering the risks that materialize, and from the investment of the money paid by clients for policies, but not yet paid out in claims (the float), to generate financial returns. We have mentioned that Fortegra focuses on specialty insurance, which involves quite specific or complex risks. And within this segment, part of their business is in non-admitted or E&S insurance, which covers a range of risks with characteristics that make them ineligible for acceptance in standard insurance lines. In return, regulators allow them more flexibility in pricing and structuring policies. Obviously, these types of risks can pose significant dangers, so the expertise of underwriters and the technology available to manage and understand statistical data is crucial. Each insurer approaches this in a specific way. Fortegra does so by placing significant importance (and money) on the work of agents and intermediaries when underwriting policies. This can be observed in several ways: firstly, because the company explicitly states it; secondly, by looking at commission expenses, which are considerably higher than those of other E&S insurers like Kinsale; (for example, Kinsale has about 14.9% commission expense2, while the commissions, i.e., acquisition ratio, in Fortegra is in the thirties.); and thirdly, because you can see the correlation between the loss ratio and commission expenses over the different financial reports. In Fortegra the compensation of intermediaries is closely tied to the performance of the loss ratio. If the loss ratio increases, compensation decreases, and if loss ratio decreases, agents are rewarded and the commission rate increases. In general, this approach has allowed Fortegra to maintain a very good combined ratio, around 90%, consistently over time. In the talk CFO gave at 2024 Southwest IDEAS Conference, he tells us that “Fortegra has not posted a combined ratio of above 94% or below 87% in any given quarter, a true testament to the underwriting consistency that we seek.

A clear example of how the loss ratio and commissions correlate to maintain a stable combined ratio can be seen in the following image:

In those Q3 2024 results, you can see a significant rise in the loss ratio, which, however, is offset by a decrease in the commission ratio, maintaining a very similar underwriting ratio and, consequently, a very similar combined ratio. Here you can see a broader picture of the same phenomenon:

The insurance mix is intentionally focusing more on commercial lines rather than personal lines, which has (the commercial ones) increased the loss ratio. Additionally, we can dig a bit deeper in this ratio and see that the Services segment, although smaller, show really good profitability.

To observe the trend and evolution of the different business lines, I am including some data from the last three years, as well as from the three quarters of 2024. While some high-growth lines appear to be slowing down or experienced a significant growth due to their own particularities (for example, fluctuations in Professional Liability), there is generally an upward trend in premiums, although it is trending toward moderation (similarly to the broader E&S industry). The data refers to Gross Written Premiums and Premium Equivalents, please keep that in mind.

Overall, we see that revenues in the insurance segment have experienced strong growth. This is not only a result of Fortegra's performance but also part of a broader trend, particularly evident in non-admitted lines, as highlighted in various industry reports. Similarly, unearned premiums (policies that have been paid for but where the coverage period has not yet elapsed, and therefore cannot yet be recognized as revenue) are also strong. This aligns with both the economic context of the insurance industry (we are currently in what is known as a hard market) and the specific context of the E&S market, as well as the broader implications of underwriting complex or highly uncertain risks. It makes sense: in an increasingly complex world with potential geopolitical conflicts and extremely new and uncertain industries (such as those related to AI and cybersecurity), it is logical that this segment of the industry continues to hold significant importance. As we mentioned in the article about E&S, although growth is slowing and is expected to continue moderating, growth will still persist, and logic suggests that its importance will only continue to rise for many companies. Management shares this perspective as well.

Fortegra is currently undergoing a significant investment process to expand its business. On one hand, it is expanding in Europe. On the other hand, it has received substantial capital injections to support growth, both through equity and debt. In terms of equity, these injections have come from its holding company, Tiptree, as well as from Warburg, a private equity player we haven’t discussed yet but will address soon. “In march of this year [2024], we along with Warburg invested an additional $40,000,000 of capital into Fortegra to support its growth objectives. And within the last month, we raised $150,000,000 through a junior subordinated note at Fortegra to fund future growth”, management said in the 2024 Southwest Ideas Conference, in November.

The investment side of Fortegra

Up to this point, we have looked at Fortegra's performance and profitability in its insurance underwriting segment. Now, let's focus on the investment side of the insurer. As of December 31, 2023, they were as follows:

Approximately $1.3 billion is invested, 15% higher than the previous year, with a significant portion held in cash. The vast majority of these investments—90%—are in fixed maturity securities. Specifically $1,191.5 million, that includes "cash and cash equivalents, available-for-sale securities at fair value, and investment-grade securities (classified under Other Investments)”.

The duration of 2.5 years aligns with the short-tail risks of its insured policies and allows Fortegra to take advantage of the new and improved bond yields resulting from higher interest rates. The duration remains similar, but the book yield has increased when comparing FY2023 or Q3 2023, to Q3 2024.

Here you can see another image from Q3, 2024. Assets invested keeps growing, maintaining a more or less similar share:

Investments are managed internally, through Corvid Peak Capital Management, a credit oriented asset manager owned by the Company.

Taking into account the returns from underwriting and investments, the company offers the following return on equity. We see that it ranges between 25% and 30% in recent periods, depending on whether we consider adjusted or unadjusted results.

In the next tables, you will find useful information and the adjustments made, with the average stockholders' equity allocated to Insurance amounting to approximately $395,661,000 in Fiscal Year 2023, which has risen to 577,776,000 by September, 2024.

On a broader scale, over the long term, Fortegra has delivered an average ROAE of 15% and an average adjusted ROAE of 21%, both measured from January 1, 2019, through December 31, 20233. So, we think the returns that Fortegra offers are strong. We see how equity has been increasing in Fortegra.

Tiptree Capital

Here I will be brief. Quoting the last annual letter, Tiptree Capital is the “our subsidiary through which we invest opportunistically in a broad range of assets and businesses”. The mortgage origination business is the by far the most important one right now within Tiptree Capital, so we are just talking about it. It is operated through a subsidiary called Reliance First Capital, and it involves issuing loans using its own or borrowed funds (through warehouse lines) and subsequently selling those loans to institutions such as Fannie Mae and Freddie Mac. First Reliance profits from the margin between the two transactions. Before going on, look at this three images:

As you can see, this business primarily depends on the volume of originated mortgages, which is currently suffering due to high interest rates discouraging new mortgage applications. This decline is somewhat offset by income from mortgage servicing. However, as seen in the last image, when the mortgage environment is more favorable, this part of the business can generate significant profits.

Although still weak, in these last nine months (see the first graph), we are seeing a slight recovery in mortgage volumes.

Furthermore, beyond that, it offers a certain counter-cyclical component in relation to the insurance side: while investments, primarily in short-duration fixed income, from Fortegra benefit from moderate interest rate hikes, mortgage loan origination will compensate when the interest rate environment is lower, and Fortegra’s capital returns are lower. Therefore, I believe that both parts form a good defensive combination, beneficial for the holding company.

A few words about the consolidated results

FY 2023 vs. FY 2022:

Q3 2024 vs. q3 2023:

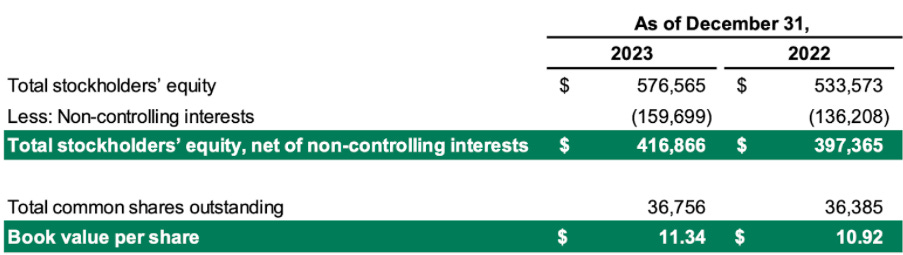

In recent years, the Company has performed well at a consolidated level. However, if we trace the Company's long-term results, we see that growth has not been as strong. Looking at the Company’s book value since 2014, despite the good returns the Company reports for its individual investments, these have not fully translated into consolidated results. That said, this trend seems to be changing in recent years, thanks to the strengthening of Fortegra. Below is the book value per share, based on data from the Company’s annual letters and presentations:

Data in $:

If you look at Tiptree's evolution over the years, its book value hasn’t changed significantly. It seems that the good returns from individual investments don’t fully translate into consolidated results. Lately, the investment in Fortegra appears to be reversing this trend. If you look at the company’s trajectory, it seems the trend is shifting toward focusing more on a few key subsidiaries, primarily Fortegra, rather than a larger number of shorter-term investments, as seemed to be the case previously.

This, however, raises uncertainties about the future: as we will see later next section, it is very likely that Fortegra will soon be monetized (sold? Taken public?), and I’m not sure what Tiptree's stake in it will be (will they maintain a majority stake and control of the company? Or not?). This raises questions if we view Tiptree’s strategy as I mentioned earlier—making Fortegra its operational core. But all of this is just me thinking out loud.

Management

What I have studied about the company gives me the impression of a high-quality management team. In their communications, they state that their Operating Principles are as follows:

Underwrite to a Profit. Our principal strategic objective is to continue expanding Fortegra’s operations, particularly the specialty insurance and service contract businesses. Our highest priority is to maintain strong underwriting practices, with attention paid to the insurance disciplines of pricing, underwriting and claims management.

Invest for Long-term Returns. Our financial goals are to generate consistent and growing earnings and cash flow, and to enhance stockholder value as measured by growth in stock price plus dividends paid. We manage Tiptree with a long-term perspective, balancing cash-flowing investments with opportunities for capital appreciation. We focus on targeting investment returns that have a combination of current earnings and long-term capital appreciation, understanding that temporary accounting gains and losses may vary significantly from one period to the next.

Think Like Owners. Efficient deployment of capital is our top priority. We aim to find the best use of capital to create long-term value for our stockholders. We hope to achieve this through a combination of investments in our existing businesses, select acquisitions and monetization opportunities, opportunistic share repurchases and paying a consistent dividend. As of December 31, 2023, directors, officers, employees and related trusts owned 33% of the Company.

As we can see in the last line, by December 2023, the company's insiders owned approximately 33% of it, a stake that, in my opinion, ensures significant alignment of interests.

Over the past 10 years, they had repurchased 15,000,000 shares of approximately 36% of the shares that were outstanding at year end 2014. In management opinion, “all of these were done at steep discounts to book and intrinsic value at the time of the purchase”.

So, we can see that investments are allocated to acquisitions, investment into their businesses, and opportunistic shares repurchases. Management has shown a trend over the years toward simplifying and reducing the holdings or businesses within the company, which I believe is a positive direction.

However, there are aspects I like less. I don’t like seeing that the strong returns are not translating into growth in the company’s book value per share, especially for a financial services-related company where book value per share is quite an indicative metric. That said, it’s also true that the company has consistently paid dividends, which is a positive aspect. Management seems honest, but there are some things I like less. Throughout the annual letters, they appear to shift their emphasis depending on what presents the company in the best light. For example, in the 2023 letter, they no longer mention book value per share and instead focus primarily on the stock price performance. In the long term, the company’s performance hasn’t been as satisfactory as it should have been. However, I also believe that management’s trend of simplifying the company and focusing on a very small number of strong businesses—primarily Fortegra, which is becoming central—is a positive development. Nonetheless, uncertainties remain. When the hard market gives way to a soft market, will Fortegra continue to perform well? Will Tiptree Capital, with its mortgage loan origination line, be able to offset potential weaknesses at Fortegra? Will the structural growth in the E&S sector and Fortegra’s strong performance be enough to counter the cyclicality of the business, ensuring that consolidated results remain strong and continue to grow? Finally, will management stick to this more simplified structure, which I believe has the potential to deliver better results than a structure with a larger number of investments that failed to translate into consolidated results or stock price growth? And, as we mentioned in the previous section, what will happen exactly when Fortegra is monetized?

Regarding Fortegra's management themselves, the fact that they have maintained a stable combined ratio of around 90% for so many years in a challenging industry like insurance indicates prudence and effective management.

The special situation

In 2021, Warburg invested approximately $200 million in Fortegra for a 24% stake in the company, and subsequent investments have increased their ownership to around 30%. The plan, it seems, was to launch an IPO for Fortegra, which would provide a favorable exit for Warburg and unlock value for Tiptree shareholders. However, the IPO was withdrawn in early 2024, supposedly because they could not achieve a valuation satisfactory to both Tiptree and Warburg.

Both parties appear to have confidence in the company's long-term prospects, as shortly after the IPO withdrawal, they made additional capital contributions, along with another injection of debt, to support Fortegra's growth within Tiptree.

The fact that a private equity firm controls 30% of the company suggests that new attempts to monetize Fortegra are likely, possibly through another IPO attempt, a sale to a larger player, or another kind of monetization. As a reference, Warburg paid 13.5 times earnings for its stake in Fortegra. Tiptree, in its latest earnings presentation, mentions a valuation range of 10 to 30 times earnings (although the high figure of 30 times should not be taken as normal, in my opinion).

If we use the lower end of the range, for conservatism, of 10 times earnings on the $102 million in net income attributable to Tiptree from Fortegra (70% of the $147 million achieved in the LTM as of Q3), we arrive at a valuation of approximately $1 billion. This represents over a 30% upside compared to Tiptree's current total valuation, being as I said very conservative.

By the way, regarding the financial structure, at a consolidated level, Tiptree has $656.2 million in equity, of which approximately $194 million represents Non-Controlling Interests, and about $461 million belongs to Tiptree. Fortegra has some debt, but CFO talks about no debt at the consolidated (i.e., Tiptree) level4.

Valuation and Conclusions

There are two ways to view the investment in Tiptree. One is by focusing solely on the realization of the special situation, which I find likely. The other is by evaluating the company itself. The company is strong enough, with sufficient quality and optionality (a turnaround in mortgage loan origination once interest rates decrease, while Fortegra continues to grow, albeit more moderately, and other businesses start to contribute as Tiptree continues its investment and divestment strategy) to be interesting on its own.

The valuation is attractive, both by comparables (we’ve already compared Fortegra to its peers and what Warburg paid for it), but we must also add that: Fortegra operates in a growing sector, even though growth may moderate; Tiptree Capital could become an important contributor; and as the holding company grows, corporate expenses will weigh less in relative terms.

So, would I invest in the company? I think the company could be a good investment, but I have some doubts (I expressed them before) and am not 100% convinced. This, combined with the fact that I currently see investments with similar potential for appreciation but (for me) lower uncertainty, means that I’m not invested and don’t plan to invest in the very short term. That said, I’m not entirely sure about this decision, and it could change at any time. For now, my current view is to stay on the sidelines, simply because I’d like to see clearer progress at the consolidated level and how the results of the subsidiaries translate into the overall company performance in a longer period. I’m aware that in holding companies, there are often dynamics within the subsidiaries or accounting practices that make this translation unclear for years. I am invested in other companies with these kinds of challenges. However, I don’t know Tiptree well enough to fully decipher these dynamics, which is why I’m currently staying out. This doesn’t mean it won’t turn out to be a good investment—just that I would need to study it further to feel comfortable with it. Perhaps in the future, because there are things that I like a lot about the Company.

On the other hand, I do think the realization of the special situation is likely. I know that waiting to see how Fortegra continues to evolve and taking the time to better understand the Company might mean it might be too late by the time I act, as the special situation—the monetization of Fortegra—might have already materialized, and the stock may no longer be attractively priced.

In any case, I think it’s an interesting company to study. Remember, this is not a recommendation of any kind—you must conduct your own analysis, perform due diligence, and make your own decisions.

Additional Resources

In addition to the usual resources used for any analysis, there are two specific ones I recommend for diving deeper into the insurance industry and E&S (Excess & Surplus) insurance.

The first is an in-depth analysis of Fairfax, another insurance company. What caught my attention wasn’t so much the company itself but the excellent explanation it provides about underwriting and investment activities in the insurance industry. The quality of the article stood out to me. Here is the link: https://junto.investments/fairfax-2/

The second recommendation, focused specifically on E&S insurance, is a post about Kinsale on the Galician Investor's Substack. Kinsale is a highly interesting and well-regarded insurer specializing in E&S. The post is not only valuable for learning about the company but also for gaining deeper insights into the Excess & Surplus insurance industry. Here is the link: https://galicianinvestor.substack.com/p/kinsale-capital-group

As always, thank you so much for making it this far. I hope you found the company interesting. Don’t forget to subscribe and share if you think it could be helpful! See you next time!

Gross Written Premiums (GWP) refers to the total premiums an insurer collects from policies issued, without any deductions. It represents the overall volume of business but doesn’t account for any risk transferred to reinsurers. Net Written Premiums (NWP), on the other hand, reflects the premiums the insurer retains after deducting those ceded to reinsurers, giving a clearer picture of the actual risk the insurer is holding.

I’ve taken this data from https://galicianinvestor.substack.com/p/kinsale-capital-group. Also you can check it out in Kinsale’s 2023 10K report, p.6.

2023 10K report, p. 11

2024 Southwest IDEAS Conference. Transcript obtained in Quartr.